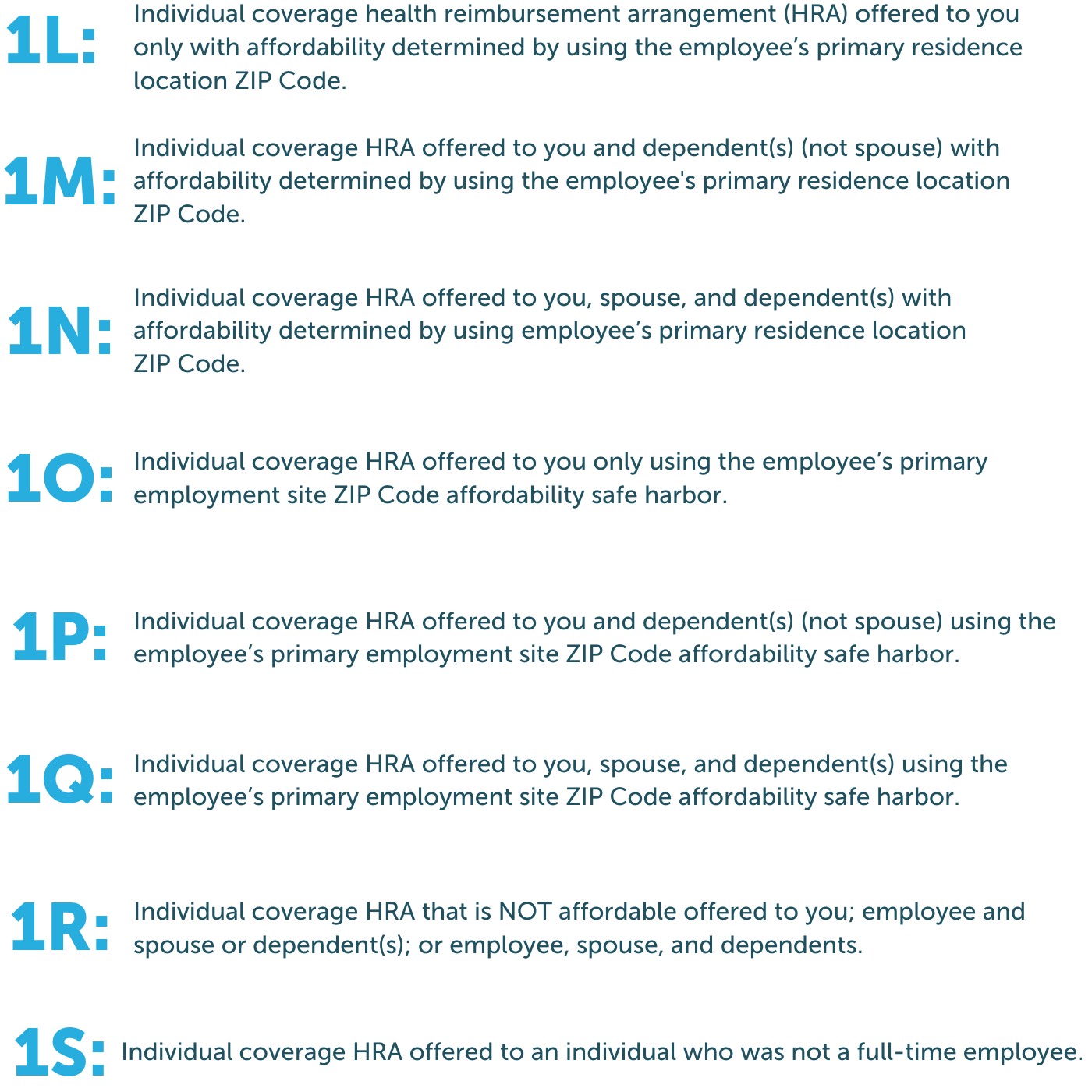

Form 1095C Code Series 1 (Line 14 of Form 1095C) Code Series 2 (Line 16 of Form 1095C) Whether Employees Were Offered Coverage Type of Coverage Offered Months Coverage Offered FullTime or PartTime Employment Coverage Enrollment Transition Relief Eligibility IRS Safe Harbor Whether Coverage was Affordable Let ACAwise handle your ACA ReportingDid you receive a 1095C and are wondering what the codes mean? The new form covers HRA plan years starting Jan 1, New codes for the 1095C For tax year , Form 1095C gets updated with brandnew offer codes employers can enter in line 14 You'll use it to indicate the type of HRA coverage offered to employees

Www Toutlesd Org For Staff Affordable Care Act Faqs

Form 1095-c codes line 14

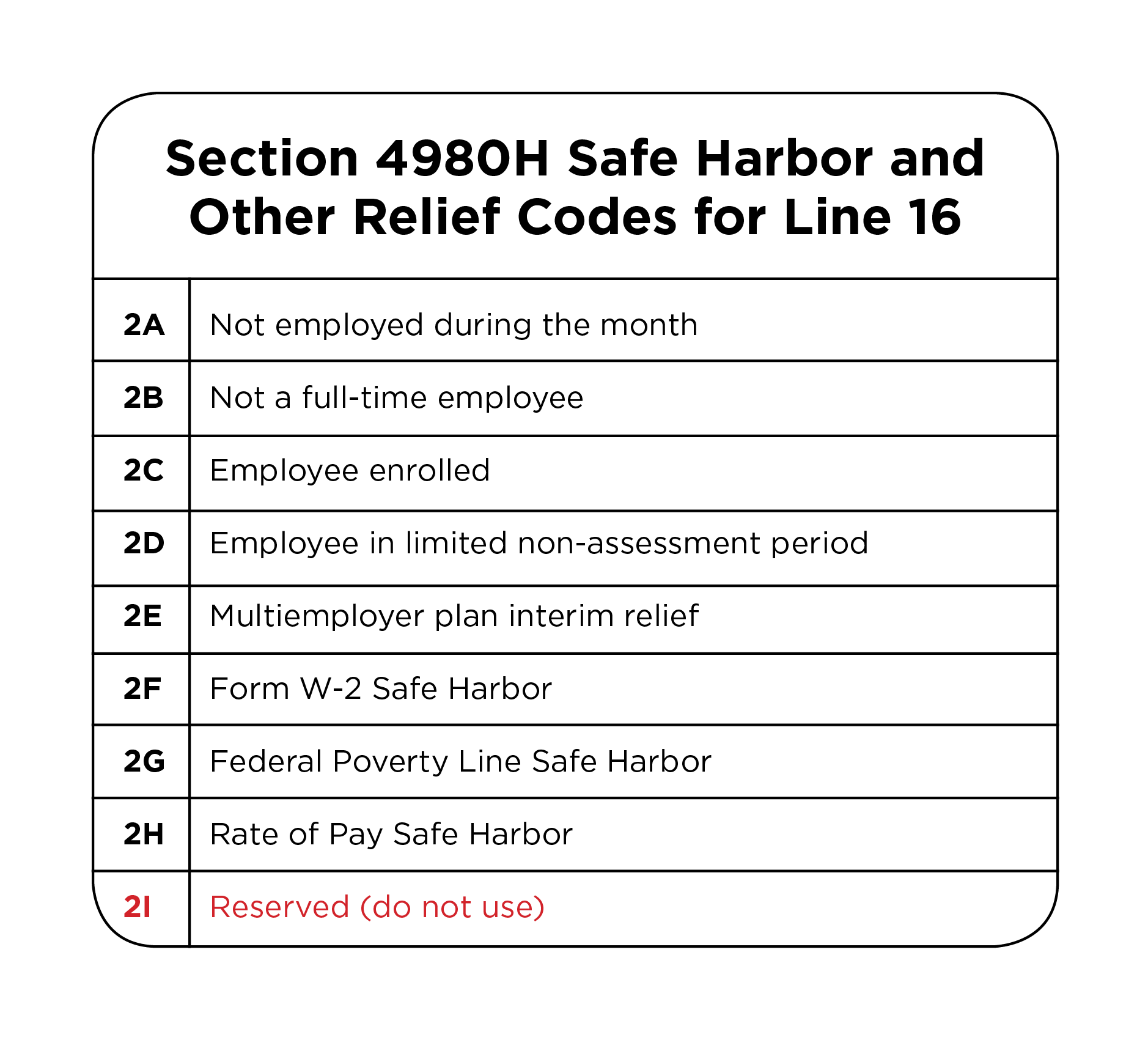

Form 1095-c codes line 14-Form 1095c codes Reap the benefits of a electronic solution to generate, edit and sign documents in PDF or Word format online Convert them into templates for numerous use, insert fillable fields to collect recipients? 18 1095C Codes For more information on how we can support your ACA reporting needs click here Section 4980H affordability Form W2 safe harbor Enter code 2F if the ALE Member used the section 4980H Form W2 safe harbor to determine affordability for purposes of section 4980H(b) for this employee for the year

Oklahoma Gov Content Dam Ok En Omes Documents Faq Irs1095creporting Pdf

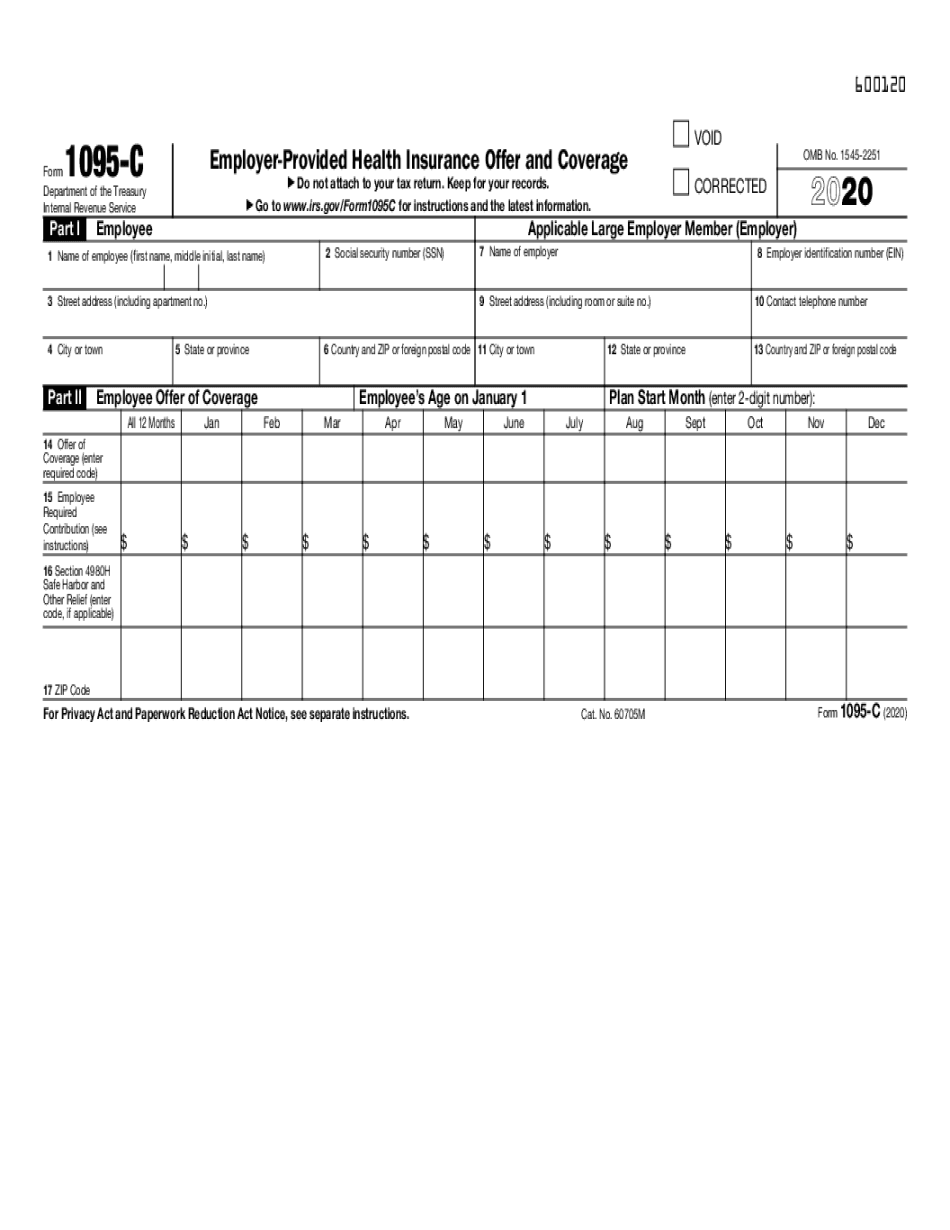

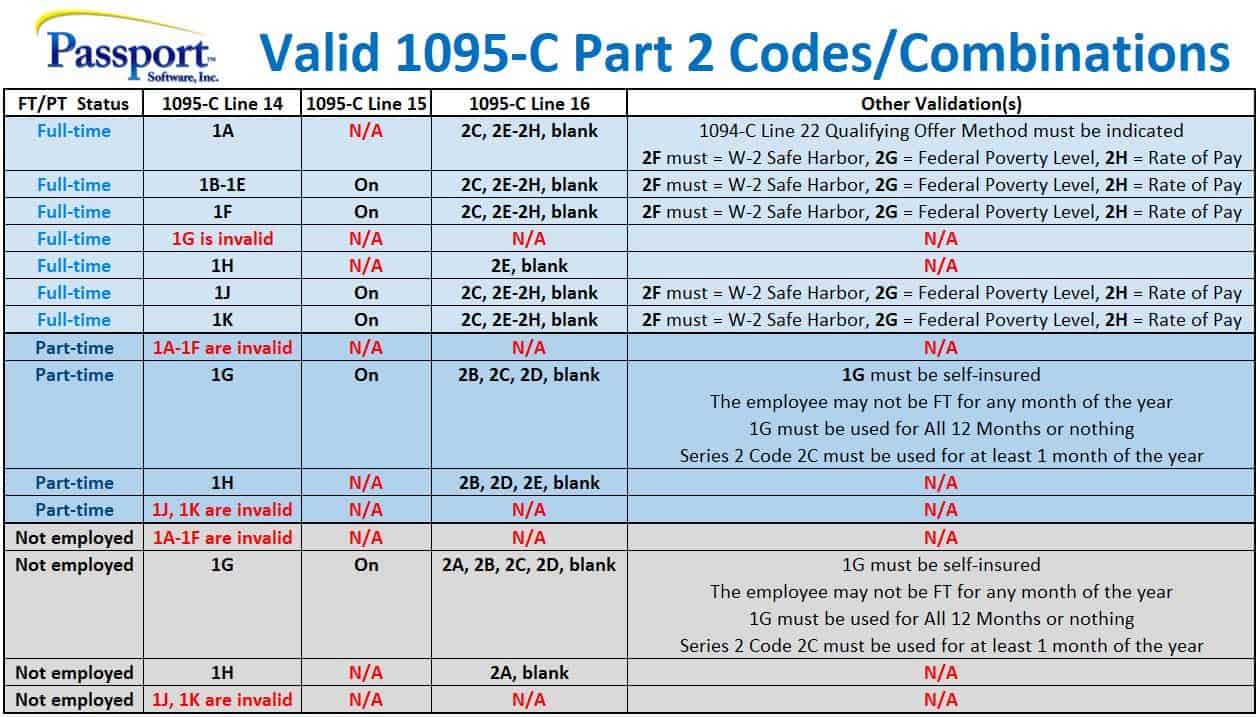

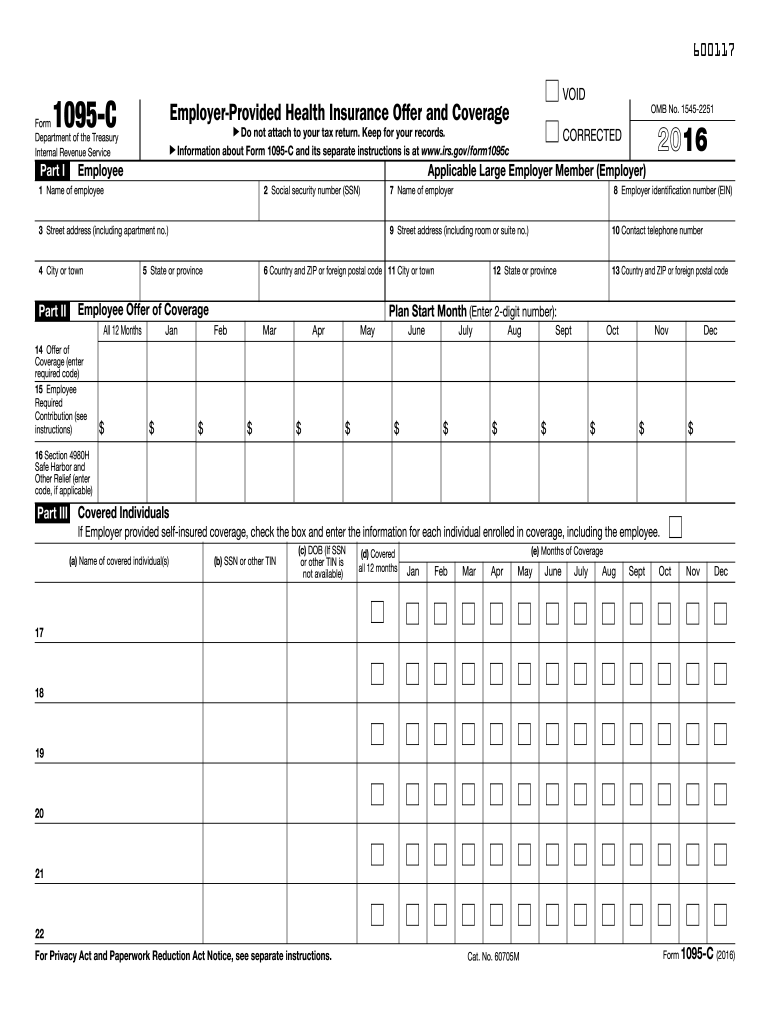

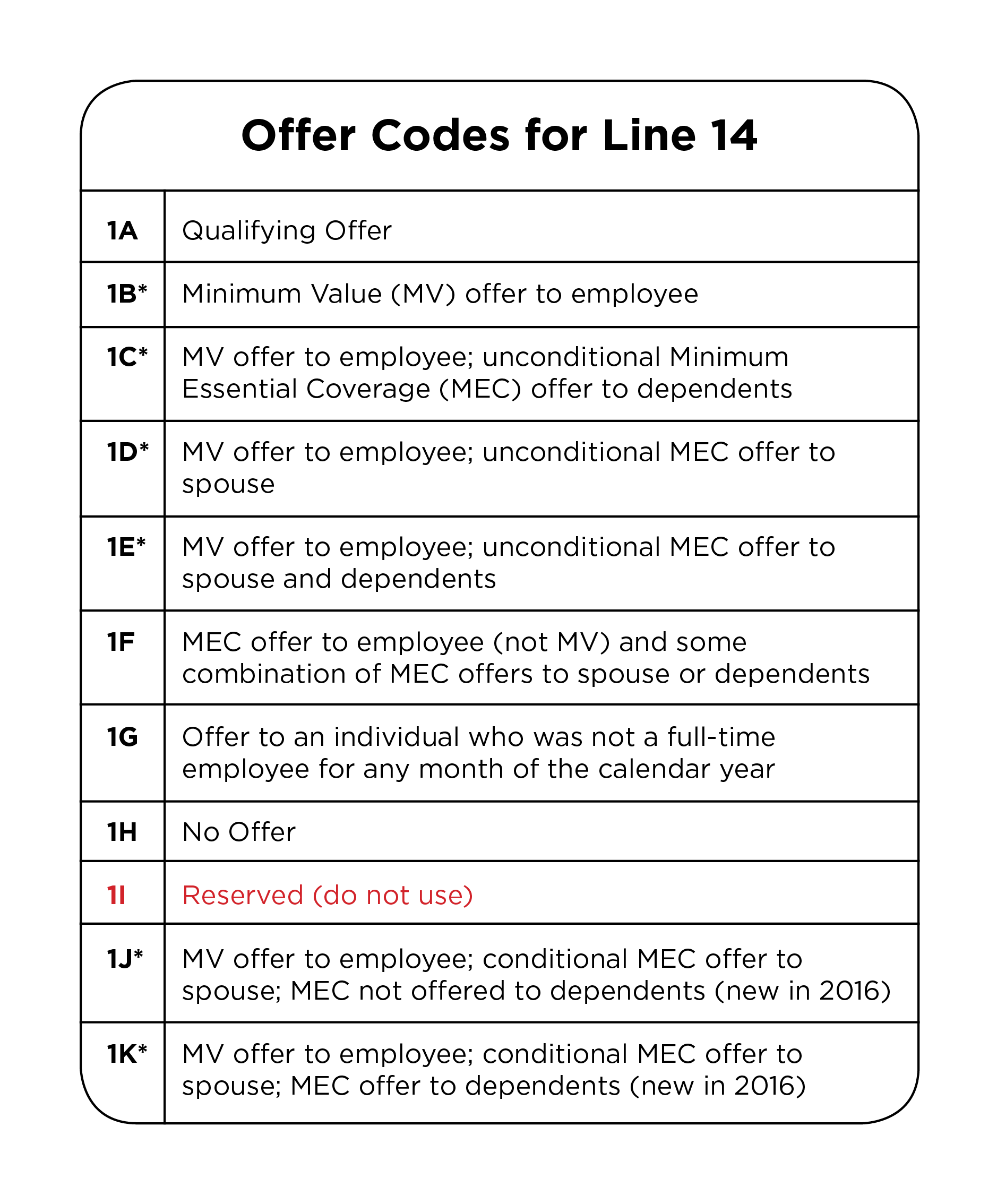

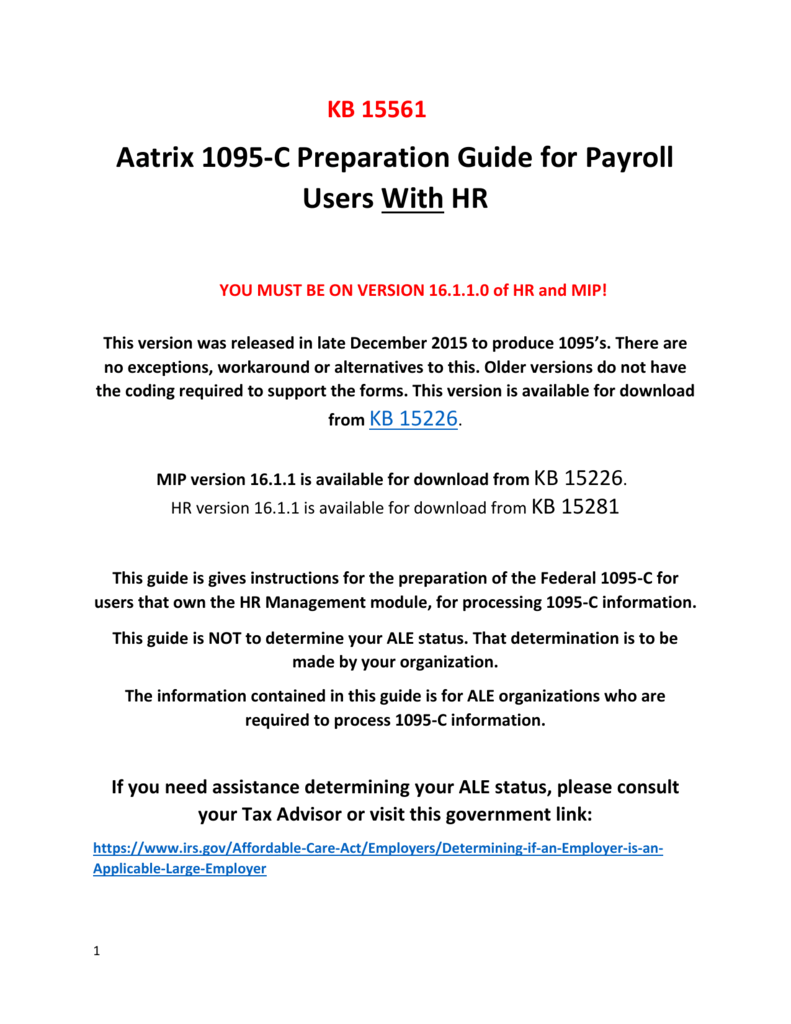

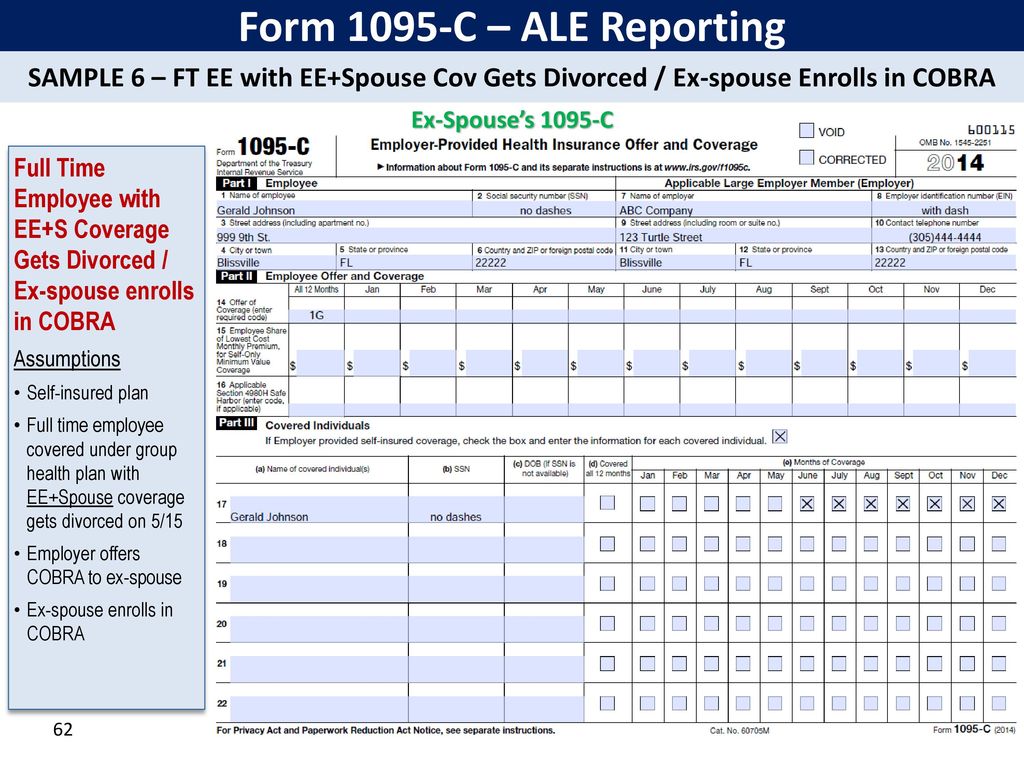

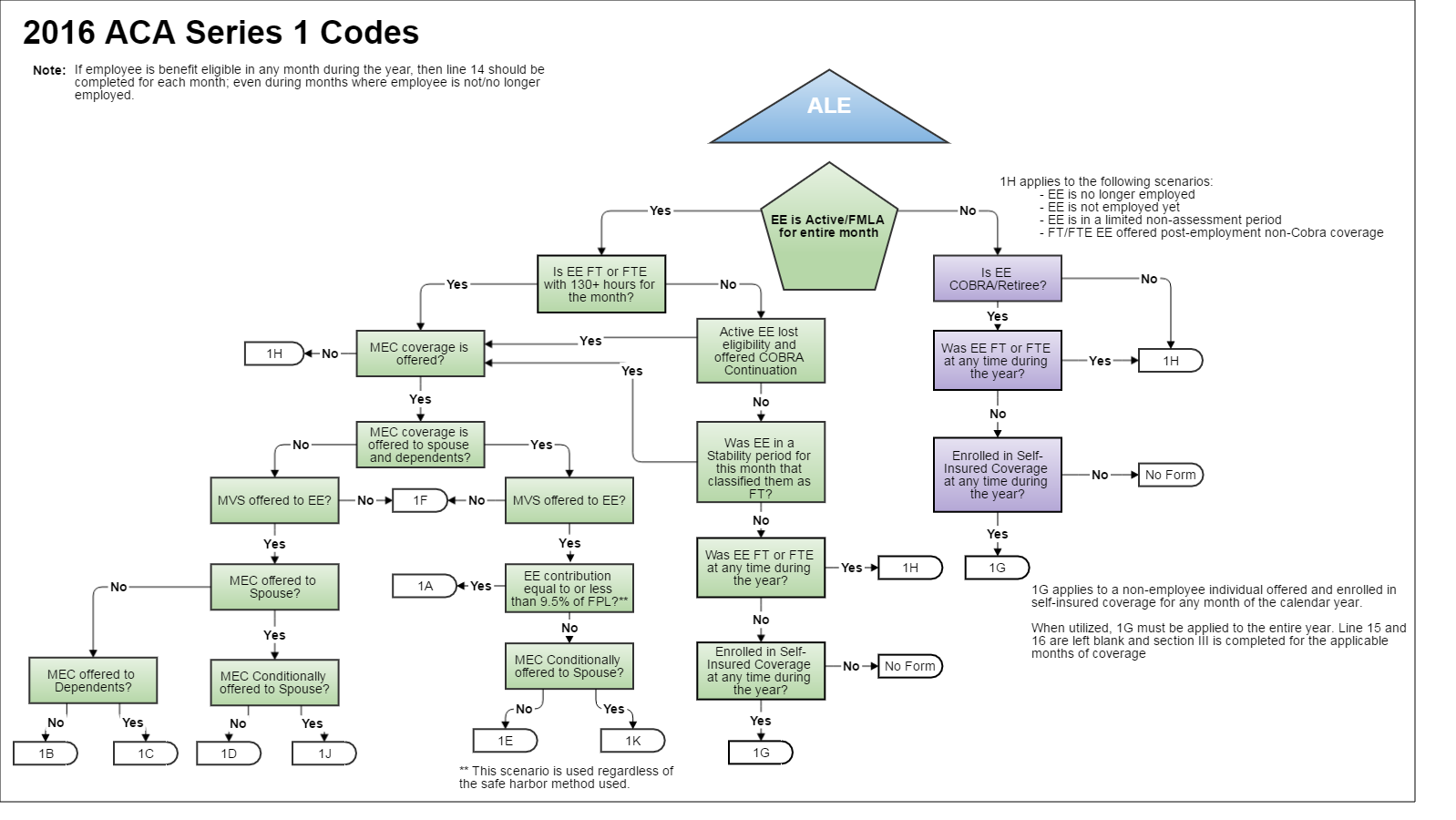

The Form Below is Form 1095C from the IRS website This guide will explain each piece of the form and help you determine the proper codes for the fields in Part II Shown below in blue, Parts I and III are comprised of lines 113 and 1734, respectively These sections are easy enough, just employee information Information from Form 1095C will also be used in determining whether an individual is eligible for a premium tax credit Line 14 of the 1095C is where an employer reports an offer of coverage that is or is not made to an employee The offer is reported by using one of nine codes, which are referred to as "Code Series 1" codes Form 1095C contains a series of codes that indicate employee health insurance coverage For traditional health coverage, applicable codes include 1A through 1H If using a benefits administration software that automates the Form 1095C process, the software should populate the codes for the months they were enrolled in coverage

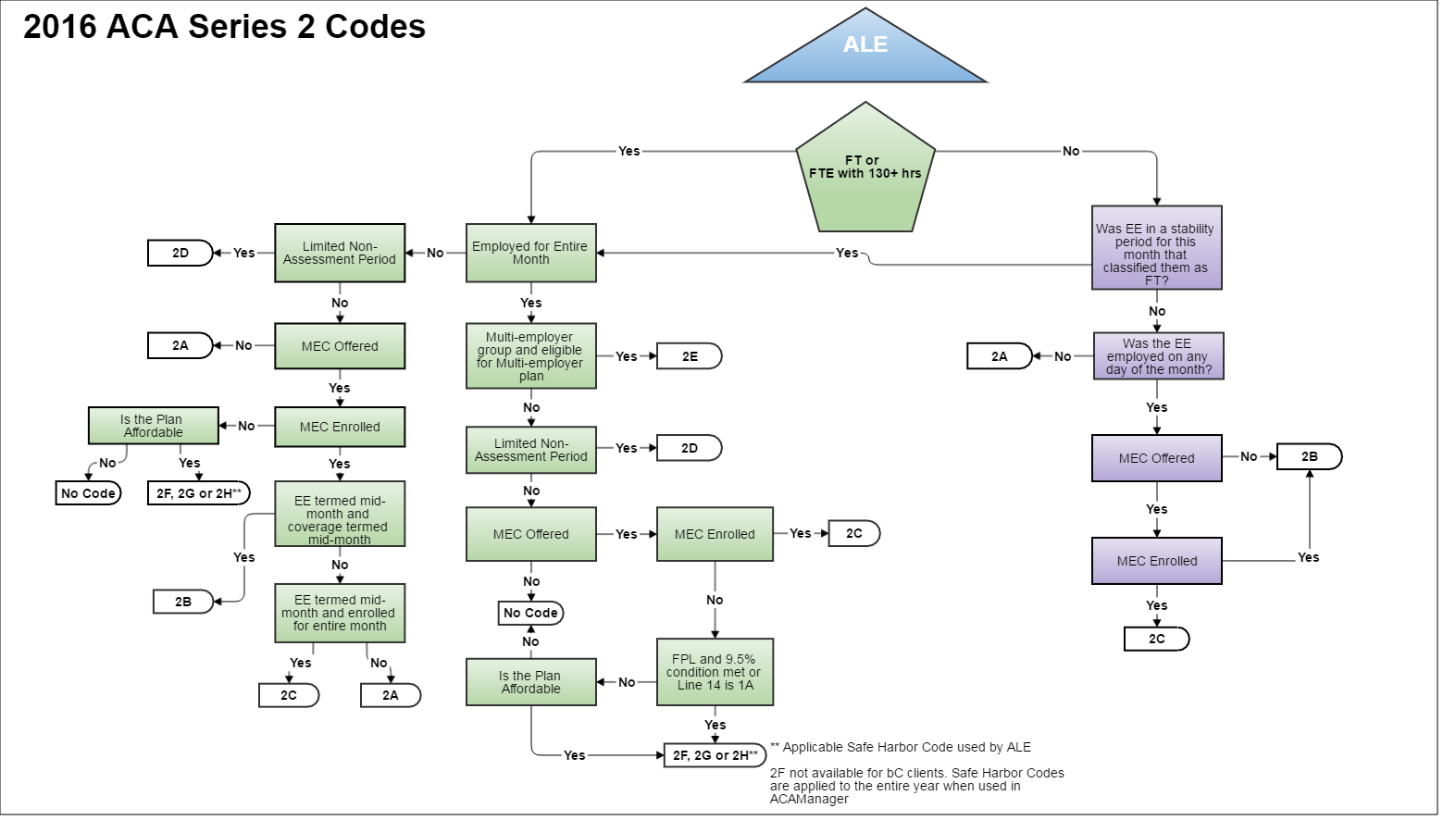

Form 1095 C Line 14 Offer of Coverage Line 14 describes the health coverage plan that you offer to your employer, spouse, and other dependents The IRS states 17 codes to enter on line 14 based on the plan offered They are 1A, 1B, 1C, 1D, 1E, 1F, 1G, 1H, 1J, 1K, 1L, 1M, 1N, 1O, 1P, 1Q, and 1S When populating Form 1095C, employers are communicating a lot of information through a series of codes on Lines 14 and 16 It is incredibly important for an employer to have documentation supporting the codes they are using when populating the Forms 1095C Below is a general breakdown of the different codes that could be entered on Lines 14 and 16 of Form 1095C1095C for a complete description of the indicator codes • An employer may use 2F, 2G and 2H to indicate that an employee declined an offer of coverage The code an employer uses depends on the reporting method or form of Transition Relief

For the tax year , there is a change in the 1095C due date New lines and codes are also released by the IRS Usually, the deadline to furnish employee copies is January 31 This year, the deadline is extended to In addition to the existing codes, new seven codes to be entered on Line 14 of Form 1095C have been added Understanding how to choose Form 1095C codes for lines 1416 can be overwhelming Managing ACA compliance all year is challenging enough, but it's essential to select the appropriate codes for Forms 1095C If you enter incorrect codes, it could mean ACA penalties and more time spent fixing those errorsForm 1095C Decoder If you were a fulltime employee working 30 or more hours per week or enrolled in healthcare coverage from your employer at any point in , you should receive a Form 1095C If you received a Form 1095C from your employer and you're not sure what the codes mean, check out our 1095C Decoder to learn more

What You Need To Know About Aca Annual Reporting Aps Payroll

What The Heck Is Form 1095 C

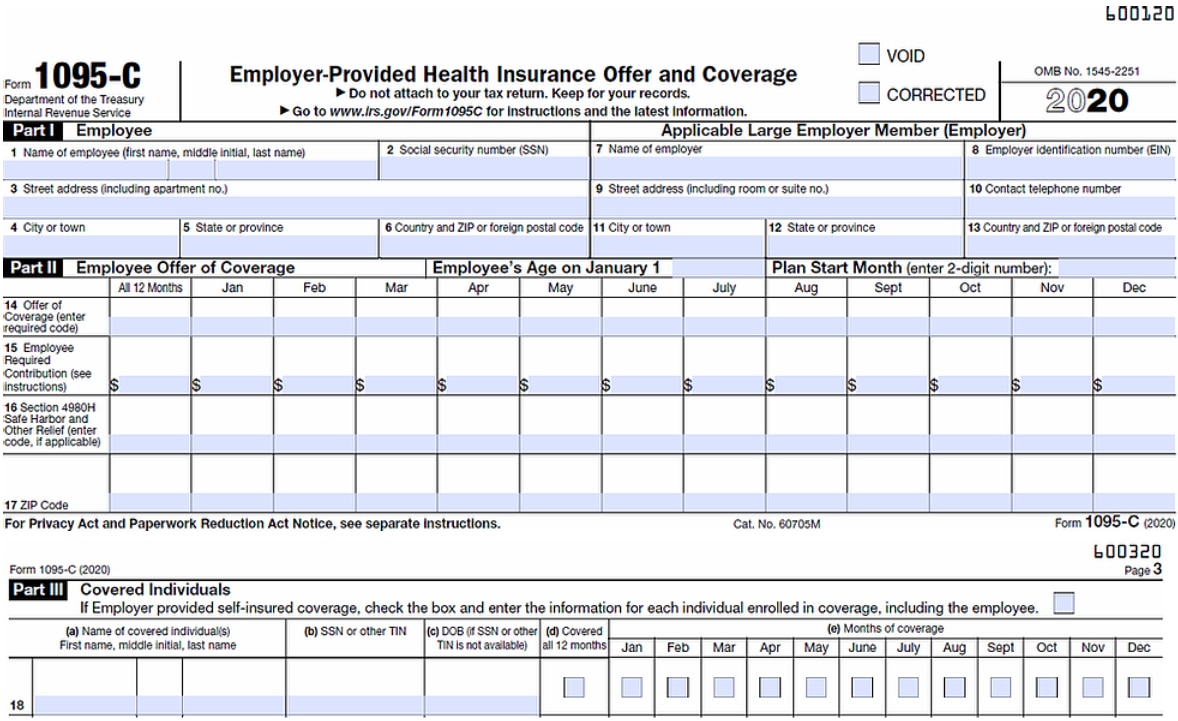

These new codes, in addition to the standard codes, must be populated on Form 1095C for fulltime employees and communicate critical information about their health coverage for the year There is a lot to remember when it comes to populating your 1095C forms and failing to get it right could result in significant ACA penalty assessments from The Internal Revenue Service (IRS) recently issued the 21 Draft Form 1095C, which is required to be filed with the IRS by applicable large employers (ALEs), to report the offer of health coverage to employees New Codes An ALE that offers an individual coverage health reimbursement arrangement (ICHRA) can now use two previouslyreserved codes in order to Below is a list of the Applicable Section 4980H Safe Harbor Codes that are valid for line 16 on Form 1095C Code 2A Employee not employed during the month Enter code 2A if the employee was not employed on any day of the calendar month Code 2C Employee enrolled in health coverage offered

Www1 Nyc Gov Assets Opa Downloads Pdf Form 1095 C 18 Info Pdf

Form 1095 C Instructions Line By Line 1095 C Instruction Explained

The IRS requires Applicable Large Employers to report their employee's health coverage information on Form 1095C While reporting this information, employers must be clear about the Codes to be entered on ACA Form 1095C Previously, we've reviewed the INS and outs of ACA form 1095C For the tax year , IRS has anticipated new codesThe type of coverage we report on Form 1095C is employersponsored coverage Below is a table explaining the different codes used on line 14 You can also find an explanation of the codes on the back of your Form 1095C Code Explanation 1A This code used is when an employer offered MEC providing minimum value to fulltime For more information, please visit the 1095C instructions, page 15 Employee Required Contribution Line 16 can be left blank since there is no specific code to indicate that an employee waived coverage, or code 2F, 2G, or 2H can be used if applicable

Www1 Nyc Gov Assets Olr Downloads Pdf Health 1095 C Form Pdf

2 3 86 Command Code Irpol Internal Revenue Service

Line 14 of IRS Form 1095C lists a code that describes whether an employee was offered coverage by their employer, the type of the coverage offered, and for which months the coverage was offered The form generation feature in the Zenefits ACA Compliance app will automatically input the applicable code, which specifies the type of coverage, if any, offered to the employee, theFilling out Form 1095C 1 – Part I (Employee) A form needs to be completed for each individual you employed fulltime for at least one month during the past year and any nonfulltime employees who enrolled in health insurance through your company (Name, SSN, and address are required) 2 – Line 713 Employer name,Form 1095C is divided into three parts Part I is used to identify the employee, and the reporting ALE entity It includes demographic information such as name, contact and demographic information, Social Security Number (SSN) and Employer Identification Number (EIN)

Irs Govform1095a Employer Provided Health Insurance Offer In Pdf

2

For the months April through December, on Form 1095C, Employer A should enter code 1H (no offer of coverage) on line 14, leave line 15 blank, and enter code 2A (not an employee) on line 16 (since Employee is treated as an employee of Employer B and not as an employee of Employer A in those months), and should exclude Employee from the count of total employees and fulltimeBox 14 Offer of Coverage The codes listed below for line 14 describe the coverage that your employer offered to you and your spouse and dependent (s), if any (If you received an offer of coverage through a multiemployer plan due to your membership in a union, that offer may not be shown on line 14) The information on line 14 relates toIRS Form 1095C is a mandatory annual health insurance statement issued by certain employers, namely applicable large employers (ALEs), to their fulltime employees All eligible employees should get a 1095C form whether the coverage is provided to them or not

/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

Oklahoma Gov Content Dam Ok En Omes Documents Faq Irs1095creporting Pdf

Data, put and ask for legallybinding digital signatures Get the job done from any gadget and share docs by email or faxForm 1095 Code Definitions Lines 14, 15, and 16 Line 14 Offer of coverage code 1A Qualifying Offer Minimum essential coverage providing minimum value offered to fulltime employee with employee contribution for selfonly coverage equal to or less than 95% mainland Form 1095A, 1095B, 1095C, and Instructions The 1095 forms are filed by the marketplace (1095A), other insurers (1095B), or by your employer (1095C) We have simple instructions for the 1095 forms Keep in mind the 1095 forms are filed by whomever provided you coverage, so individuals won't have to fill them out themselves

Www Toutlesd Org For Staff Affordable Care Act Faqs

1

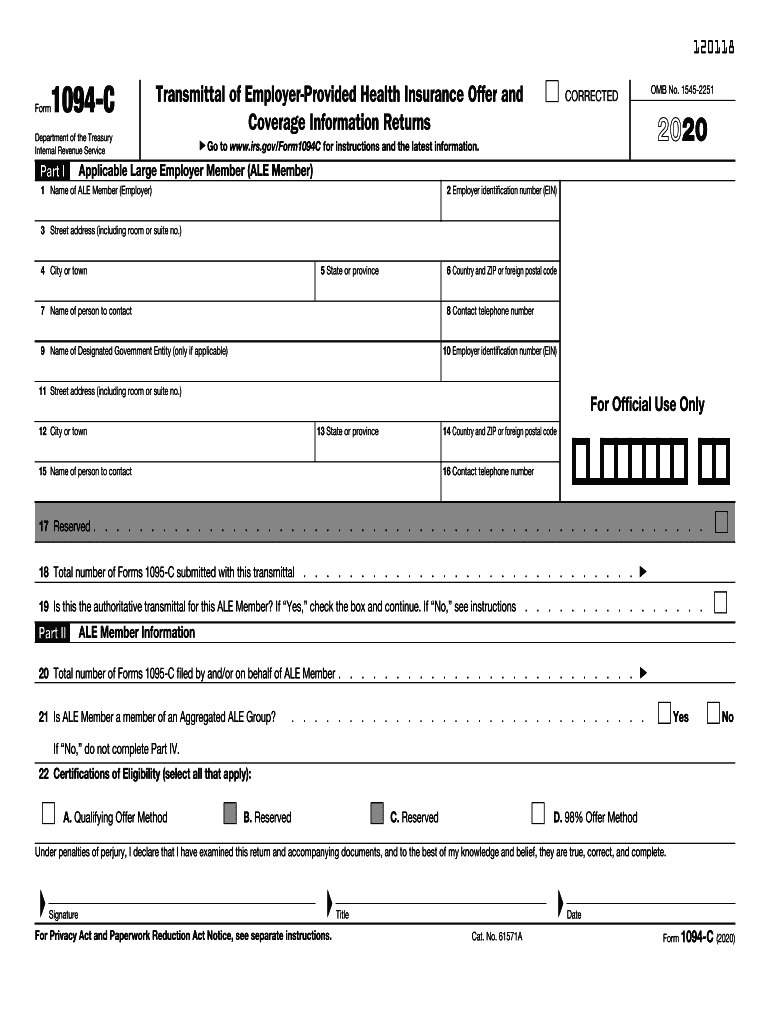

1095C C Form Instructions The IRS has released final Forms 1094C and 1095C (C Forms) and final instructions for the C Forms for the 17 tax year (Final Forms 1094/1095B, but not the instructions, have also been released We'll cover those items in a separate article after the final instructions become available)Inst 1094C and 1095C Instructions for Forms 1094C and 1095C 16 Inst 1094C and 1095C Instructions for Forms 1094C and 1095C 15 Inst 1094C and 1095C Instructions for Forms 1094C and 1095C 14 Form 1095C EmployerProvided Health Insurance Offer and Coverage Form 1095C Plan Start Month All Applicable Large Employers (ALEs) must enter a twodigit code on Form 1095C Age and ZIP Code Inclusion If an employee was offered an ICHRA, employers must enter the employee's age as of Jan 1, Similarly, the employer must submit the ZIP Code of either the employee's permanent residence (codes 1L, 1M, or 1N) or the primary

Irp Cdn Multiscreensite Com Fd05f735 Files Uploaded Aca user guide to the 1095 C form and associated codes Pdf

Convatecbenefits Com Wp Content Uploads 19 06 19 1095 Form Model Notice Si Pdf

Chec k out our Form 1095C Decoder View Our Sample Form 1095C What is the difference between a 1095A, 1095B, and 1095C?Code Series 2—Section 4980H Safe Harbor Codes and Other Relief for ALE Members (Form 1095C, Line 16) CODE SERIES 2* 2A Employee not employed during the month Enter code 2A if the employee was not employed on any day of the calendar month Do not use code 2A for a month if the individual was an employee of the ALE Member on any day of the calendarForm 1095C IRS Form 1095C will primarily be used to meet the Section 6056 reporting requirement The Section 6056 reporting requirement relates to the employer shared responsibility/play or pay requirement Information from Form 1095C will also be used in determining whether an individual is eligible for a premium tax credit

The New 1095 C Codes For Explained

Irs Affordable Care Act Reporting Forms 1094 Ppt Download

Form 1095C Code Calculator Here is how it works Simply select the codes below for lines 14 and 16 below and then press search You will then see the full logic as to why certain code combinations work or do not work Enter Line 14 Code * 1AACA Code 1A alert IRS clarifies 1095C guidance for a Qualifying Offer Integrity Data Code 1A alert On , the IRS revised ACA reporting guidance on how employers document a qualifying offer of health coverage on Form 1095C1095C 14–Code 1 Series 1 code must be entered in line 14 to indicate the type of coverage offered (or no coverage offered) to the employee and family Enter a code for each month, or enter one code in the "all 12 months" box if the same code applies for the entire calendar year

1

2

The forms are very similar The main difference is who sends the form to you The entity that provides you with health insurance will be responsible forEach Form 1095C would have information only about the health insurance coverage offered to you by the employer identified on the form If your employer is not an Applicable Large Employer, it is not required to furnish you a Form 1095C providingReference Guide for Part II of Form 1095C Lines 14, 15, and 16 (revised for the final 17 forms) November 17 • Lockton Companies L O CKT O N CO M P ANIES GLOSSARY Children means an employee's biological and adopted children (including children placed with the employee for adoption), from birth, adoption, or placement through the end of the month in which the child

2

Form 1095 C Released New Codes New Deadlines

Last week our Health Care Reform article explained the Codes for completing Line 14 of Form 1095C This week we focus on completing Line 16 of Form 1095C Applicable Large Employers (those with 50 or more fulltime/fulltime equivalent employees in the prior year) should be in the process of completing their ACA formsForm 1095C Line 16 Codes are used to report information about the type of coverage an employee is enrolled in and if the employer has met the employer's shared responsibility "Safe Harbor" provisions of Section 4980H The table below explains the code series 2 If using form 1095C for COBRA reporting, you would enter codes 1G and 2A in part II lines 14 and 16, respectively Line 15 is not required as affordability is not assessed for COBRA individuals Do retirees who receive health insurance benefits need form 1095C

Irs Releases Form 1095 With Changes For Ichra Plans Health E Fx

Http Www Lockton Com Resource Pageresource Mkt Compliance Lines 14 And 16 Cheat Sheets Cr Pdf

IRS Reporting Tip #2 Form 1095C, Line 14, Code 1A versus 1E, and When To Use 1I Under the Patient Protection and Affordable Care Act (ACA), individuals are required to have health insurance, while applicable large employers (ALEs) are required to offer health benefits to their fulltime employeesThese annual statements are recorded on Form 1095C For employers to consistently describe their health coverage offers to employees, the IRS created different sets of codes to be entered into lines 14, 15, 16, and 17 on Form 1095CForm 1095C, Line 15 Employee Share of Lowest Cost Monthly Premium for SelfOnly Minimum Value Coverage Complete line 15 only if code 1B, 1C, 1D, or 1E is entered on line 14 either in the "All 12 Months" box or in any of the monthly boxes

The Codes On Form 1095 C Explained The Aca Times

Aca Code 1a Alert Irs Clarifies 1095 C Guidance For A Qualifying Offer Integrity Data

Irs Final Aca Compliance Forms Now Available Bernieportal

Irs Issues Draft Form 1095 C For Aca Reporting In 21

Tmlhealthbenefits Org Forms Tml Displaydoc Aspx Doc Id 694 Form Webinar

Irs 1094 C 21 Fill Out Tax Template Online Us Legal Forms

Www Irs Gov Pub Irs Prior F1095c 17 Pdf

Aca Reporting For Just Got More Complicated Syncstream Solutions

Consulting Americanfidelity Com Media 1435 17 11 30 17 Instruction Guide Step 1 Pdf

Www Irs Gov Pub Irs Prior Ic 14 Pdf

/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

1

21 Aca Form 1095 C Line 14 16 Code Sheet By Acawise Issuu

Changes In Irs Form 1095 C For Taxbandits Youtube

Www Schoolcare Org Uploads Files Video Transcript Irs Reporting Updates Part 2 Pdf

2

Aca Forms 1094 C And 1095 C And Reporting Instructions For The Aca Times

Form 1094 C 1095 C Reporting Basics And Ale Calculator Bernieportal

Irs Releases Draft Aca Reporting Forms Sequoia

Aca Reporting Solution Passport Software Inc

Irs Release Drafts Of Irs Forms 1094 C And 1095 C The Aca Times

16 Form Irs 1095 C Fill Online Printable Fillable Blank Pdffiller

Nmpsia Com Pdfs Segal aca reporting 15 07 Pdf

The New 1095 C Codes For Explained

1

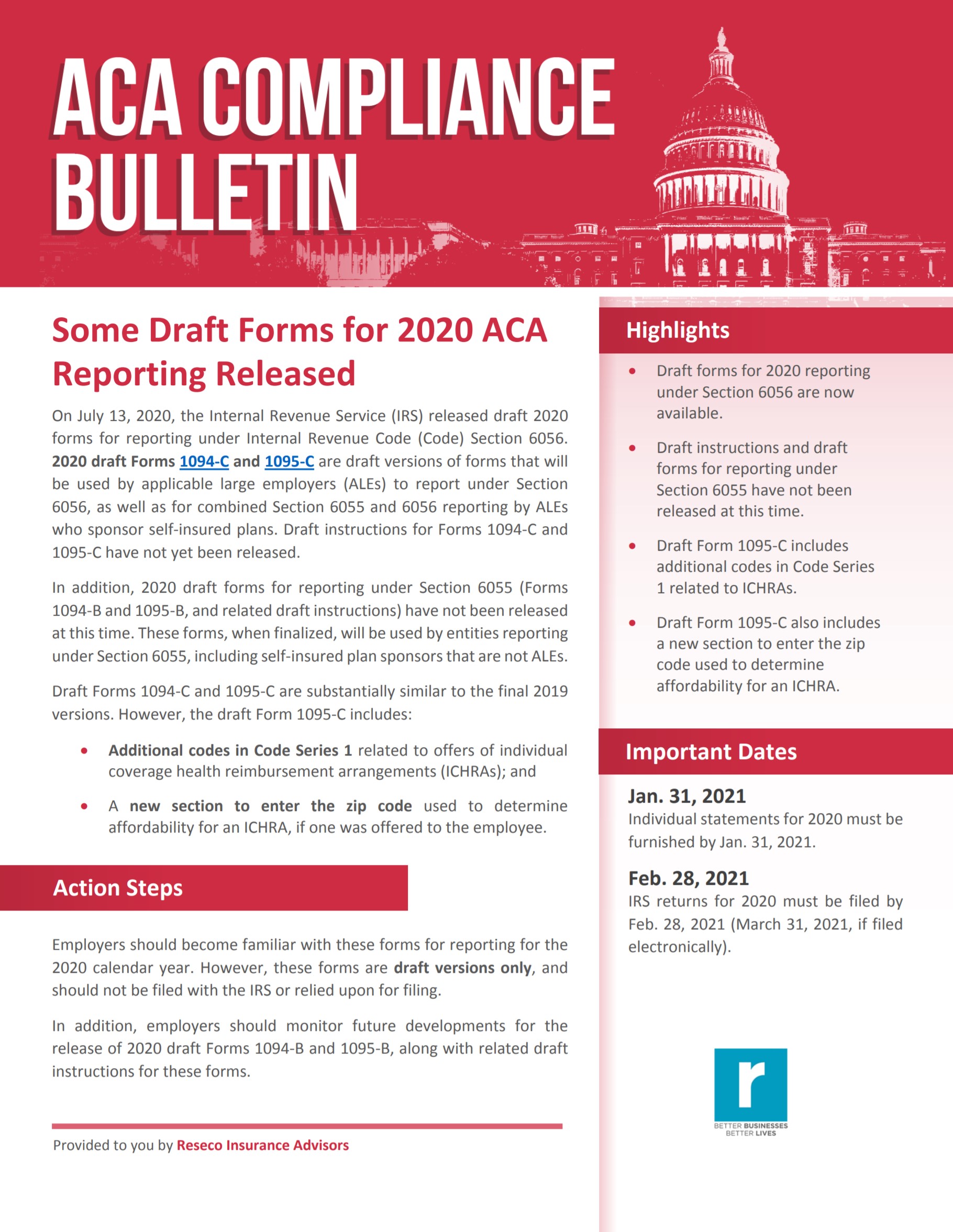

Some Draft Forms For Aca Reporting Released Resecō

Www Ddouglas K12 Or Us Wp Content Uploads 17 11 From 1095 Faq 17 Pdf

Www Hubinternational Com Media Hub International Pdf Employee Benefits Aca Decoding Codes Pdf

1095 C Reporting How To Use Affordability Safe Harbors For Integrity Data

Bracing For An Aca Form Boomerang Next Steps For Undeliverable 1095 Cs Integrity Data

Aca 1095 C Basic Concepts

Aca Codes A 1095 Cheat Sheet You Re Gonna Love Thread Hcm

Files Nc Gov Ncosc Documents Training Job Aids Benefits Ben 1 1095 C Faqs A Pdf

Changes In 21 Aca Reporting Health Insurance Coverage Employment Health Plan

United Benefit Advisors Home News Article

Tmlhealthbenefits Org Forms Tml Displaydoc Aspx Doc Id 694 Form Webinar

2

Aca Reporting Tip 19 Self Funded Plans Usi Insurance Services

Consulting Americanfidelity Com Media 1435 17 11 30 17 Instruction Guide Step 1 Pdf

2

2

Www Fauquiercounty Gov Home Showpublisheddocument

Http Www Nexgenhce Com Images 16 Aca Reporting Nex Gen 10 16 Pdf

1095 C Faqs Mass Gov

Www Emiia Org Writable Files Filling Out Form 1094 C 1095 C 1 26 17 Pdf

Aca Paragon Compliance

Peba Sc Gov Sites Default Files 1095c Code Explanation Pdf

Http Cdn Complyright Com Downloadables Aca Faqs Pdf

Www Rjuhsd Us Cms Lib Ca Centricity Domain 28 Affordable care act Irs forms 1095b 1095c faq 1 22 16 Pdf

Http Www Psfinc Com Hcr Files Agwebinarseries 10 26 17 Pdf

Http Www Fleming Kyschools Us Userfiles 4 My files Finance 1095c letter to employees Pdf Id

Irs Q A About Employer Information Reporting On Form 1094 C And Form 1095 C California Benefit Advisors Johnson Dugan

Form 1094 C 1095 C Reporting Basics And Ale Calculator Bernieportal

Ess Mo Gov Admin Attachmentviewer Id 168

Aca Employer Reporting Requirements 1094c 1095c Efile4biz

Aca Elite Generate Codes E File 1095 C Forms

F Hubspotusercontent00 Net Hubfs 1095 C cheat sheet Employers Pdf

Employee 1095 C

Form 1094 C 1095 C Reporting Basics And Ale Calculator Bernieportal

Employeeservices Sccgov Org Sites G Files Exjcpb531 Files How to read your 1095 C Pdf

Www Whoi Edu Fileserver Do Id Pt 2 P 769

Aca Code 1a Alert Irs Clarifies 1095 C Guidance For A Qualifying Offer Integrity Data

Aca Code Cheatsheet

Aca Code 1a Alert Irs Clarifies 1095 C Guidance For A Qualifying Offer

2

2

1095 C Template Fill Online Printable Fillable Blank Pdffiller

Irs Affordable Care Act Reporting Forms 1094 Ppt Download

Draft Irs Reporting Forms Released

Good Sense Guide To Minimum Essential Coverage Forms 1094 C And 1095 C California Benefit Advisors Johnson Dugan

Http Needham Ss13 Sharpschool Com Userfiles Servers Server File Departments Administrative Human resources Employee paycheck info Form 1095c Codes and form Pdf

Employer Reporting Forms 1094 C And 1095 C Hays Companies

Employeeservices Sccgov Org Sites G Files Exjcpb531 Files Documents 1095 C Attachment Faq Pdf

Download Instructions For Irs Form 1094 C 1095 C Pdf Templateroller

United Benefit Advisors Home News Article

Updates To Form 1095 C For Filing In 21 Youtube

Aca Code Cheatsheet

Www Basiconline Com Wp Content Uploads 15 12 1095 Employee Communication 15 Pdf

Irs Announces Changes With Aca Reporting Forms And Instructions Onedigital

Www Irs Gov Pub Irs Prior F1095c 15 Pdf

Dominionpayroll Com Wp Content Uploads 1094 1095 Review Guide Pdf

How To Choose Form 1095 C Codes For Lines 14 16 Aps Payroll

0 件のコメント:

コメントを投稿